GaN and SiC Markets: A Boom in Wide Bandgap Semiconductors

Insights | 05-07-2024 | By Gary Elinoff

![]() GaN, SiC and Silicon compared. Image source: Infineon

GaN, SiC and Silicon compared. Image source: Infineon

Key Takeaways about Riding the Wave: The Boom of GaN and SiC Markets:

- Gallium Nitride (GaN) and Silicon Carbide (GaN) are members of a new class of power semiconductors known as Wide Bandgap semiconductors (WGB)

- WGBs make a great increase in electrical efficiency possible in a wide range of applications.

- Market size estimates are in the $1.5 to $2.0 billion range, and a CAGR of over 25% is postulated.

Introduction

GaN and SiC are examples of a new type of power superconductors. These components, members of a class of devices collectively known as wide bandgap (WBG) semiconductors, are revolutionizing the way that electrical power can be converted between AC and DC and the way voltage levels can be altered.

This is far more significant than one might think. For example, an electric vehicle’s (EV) battery, its “gas tank”, can store about 200 kilowatt hours of power at 800 DC volts. However, most EV main drive motors run at AC voltages in the range of 400 to 800 AC volts, and there is a wide catalog of other EV subsystems and devices that require either AC or DC at a multitude of voltage levels.

These conversion processes are at the heart of what makes EVs and many other modern electrical devices tick. WBGs can do so far more efficiently than classical silicon (Si) semiconductors can.

Estimates of present market size in mid 2024 vary, but most source’s estimates place it at from $1.5 to $2.0 billion dollars world wide. Of course, the future is a risky business, but most analysts estimate a CAGR of over 25%, to a value of over $20 Billion in 10 years.

However, these estimates, although agreed upon by a wide range of analysts, may be overly sanguine. At this writing, the largest, but by no means the only user of WBG semiconductors, is the EV industry, which is itself undergoing a significant slowdown. This decline may not be turned around any time soon, so the future size of the WGB semiconductor market is open to some doubt.

The Value Proposition for SiC and GaN

Before we delve into the market itself, let’s take a brief look at what goes on inside WGBs and why they loom so large in the world of power electronics. In a nutshell, WGBs enjoy three main advantages over last-generation silicon-based semiconductors:

- Most types of power conversions, AC to DC, DC to AC, or voltage level changes involve “sampling” of the source voltage many thousands of times per second; the faster, the better. WGBs can achieve a far greater rate of this sampling than silicon semiconductors.

- When a WBG semiconductor turns “ON” to affect the sampling, it does so with far less internal resistance, so less power is wasted in the form of heat.

- Finally, WGBs can not only operate at higher temperatures, but they can also dissipate that heat more expeditiously.

Previous Electropage articles cover these topics in great detail. These articles include Power Electronics in EVs: Key Roles and Challenges, Silicon Carbide and Gallium Nitride for EV Power Efficiency, and The Evolution of GaN in Consumer Electronics: Key Insights.

Who Are the Players?

GaN and SiC are both WGBs, but they have somewhat different characteristics making each better suited for their own range of applications. Simply put, GaN is not only less expensive than SiC, but it can switch faster, SiC, on the other hand, can handle more power.

GaN Producers

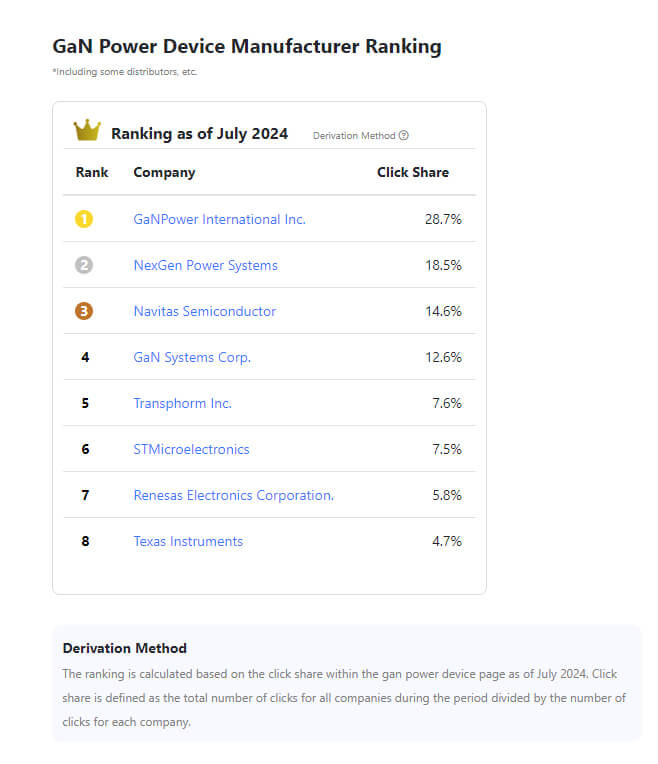

GaN Producers. Taken from: Metoree

The reader should keep in mind that the sands are constantly shifting. For example, GaN Systems has been absorbed by Infineon.

Uses for GaN devices include IT, defence, consumer devices, automotive and industrial Applications.

SiC Producers

As reported by Verified Market Reports[1], the Top Ten are:

- Wolfspeed

- Infineon

- ROHM

- ON Semiconductor

- STMicroelectronics

- Mitsubishi

- GeneSiC

- TT electronics

- Vishay

- Solitron

What are the WGBs Used For?

Uses for GaN devices include IT, defence, consumer devices, and automotive and industrial applications.

For SiC Semiconductors, a very different picture emerges.

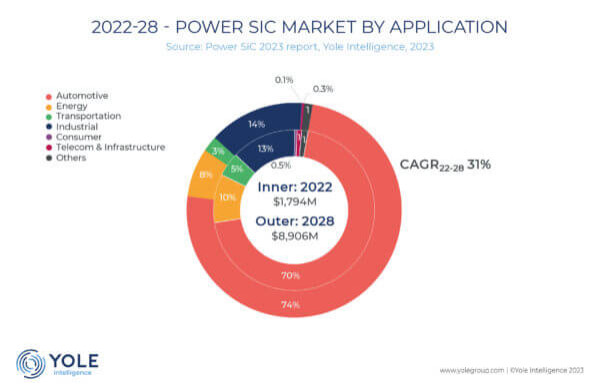

SiC Market by Application. Image source: Yolegroup

As we can see, in the recent past and in the near future, almost three-quarters of the entire market is automotive. This will have a profound effect on the future of the power SiC market.

The Effects of the Slowdown in Demand for EVs

As noted, the Electric Vehicle industry is one of the most important destinations for WGB semiconductors. There is currently a major slowdown in the demand for EVs, and it is having a major impact on the outlook for WBG production.

As reported by Evertiq[2], Wolfspeed, one of the major producers of SiC semiconductors, has put its plans for building a modern, automated plant in Saarland, Germany, on hold, at least until 2025. Evertiq reports that this decision may have been influenced by the company’s 51 per cent decline in its stock price over the past year.

Wolfspeed, based in North Carolina, maintains that it will concentrate its efforts on its rapidly developing site in Upstate New York for the time being. And on a more positive European note, Onsemi, another major WBG player, is reported by Evertiq to be planning to spend $2 Billion on its Czech operations.

Challenges and Opportunities

It’s said that globalization is slowing down, and may even be reversing. For that reason, WGB manufacturing plants will need to move away from regions “in doubt” to closer, more defensible locations.

While costs are coming down, the high cost of manufacturing WBGs is a serious challenge. This is especially true for SiC.

And, of course, a nationwide EV charging network is still in its infancy, which is crippling the adaptation of EVs and hurting the demand for SiC semiconductors in turn.

As reported by DW[3], in 2015, no less an authority than Elon Musk himself said existing batteries “suck”. Whether or not the sage’s opinion has changed, even under the best of circumstances, it still takes far too long to charge an EV’s battery.

While the charging network can be bulked up if a will to do so ever develops, it would take major breakthroughs in science and engineering to improve the lithium-ion batteries that power EVs. If and when these issues are surmounted, the demand for SiC and rapidly improving GaN semiconductors will surge beyond what even now exists.

Wrapping Up

WBGs are the future of power electronics because saving energy is the powerful ethic driving the world as a whole and the electronics industry in particular. And because these devices do a superior job in controlling heat, less costly, heavy and bulky heat shielding will be necessary.

The use cases for SiC and GaN feature major overlaps. GaN is steadily increasing its power handling capacity. SiC, thanks to the movement from 6 inch to 8 inch wafers, is getting cheaper to produce. Yield and reliability are improving, too.

With the growth of bitcoin mining, the internet of things, streaming video and lately server based AI, the power being required to operate server farms is exploding. Through greater efficiencies, WBGs will make it possible to lessen the absolute server power requirements.

A possible pause in EV adaptation is looming, which may slow down the need for SiC. On the other hand, the establishment of renewable energy systems is proceeding apace. As reported in another Electropages article, “Silicon Carbide and Gallium Nitride Tame the Wind and the Sun” (not yet published), these systems, and the power grid they support, require multiple voltage level changes and conversions from AC/DC/AC. SiC will make it possible to transition from inefficient 20th-century solutions to modern, energy-saving methodologies.

References:

- Navigating the Future: Top 10 Leading Silicon Carbide Semiconductor Manufacturers: https://www.verifiedmarketreports.com/blog/top-10-companies-in-silicon-carbide-semiconductor/

- Wolfspeed delays Germany site build to mid-2025: https://evertiq.com/news/55930

- Tesla’s batteries: https://www.dw.com/en/tesla-unveils-batteries-for-homes-businesses/a-18423089

Glossary of Key Terms:

- CAGR. Compound annual growth rate. This is the average annual revenue growth rate for a market or an investment over a period of years.

- WGB. Wide bandgap semiconductors, starting silicon carbide and gallium nitride.