Mineral Supply Chain Bottlenecks Impacting EV Growth

Insights | 12-09-2024 | By Liam Critchley

New tailpipe emission standards are coming in the US to increase electric vehicle (EV) sales. However, the manufacturing of EV batteries requires large volumes of speciality minerals. Meeting the mineral demands if the sale volumes of EVs is drastically increased is going to be tricky with the current supply chains. EVs are known to reduce greenhouse gas emissions compared to internal combustion engine vehicles (ICEVs) but the mining and using of rare minerals is always brought into question.

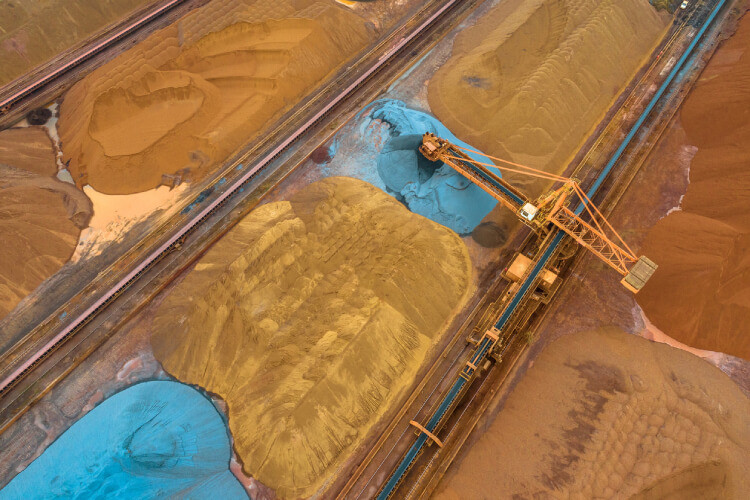

Raw material supply chain bottlenecks are potentially a big obstacle to the transition to EVs on a wider societal level. EVs require cobalt, graphite, lithium, nickel, and rare earth minerals in much larger quantities than ICEVs. EVs also require twice the weight of copper and manganese compared to ICEVs. One of the main questions being asked is, do mineral demands for electrifying a wider EV demand exceed the available supply? This is a timely question, particularly in the US, where emissions from ICE-powered light-duty vehicle fleets contribute significantly to carbon emissions.

Here are the key things to know:

- New EV Emission Standards: The US is setting new tailpipe emission standards to boost electric vehicle (EV) sales, aiming to reduce carbon emissions from traditional internal combustion engine vehicles (ICEVs).

- Mineral Supply Chain Challenges: EV battery production requires significantly higher amounts of minerals like cobalt, graphite, and lithium, creating potential supply chain bottlenecks that may hinder EV manufacturing.

- Graphite and Cobalt Shortfalls: Graphite and cobalt are identified as the key limiting factors, with the US needing to drastically increase production—by up to 880% for graphite—to meet EV demand by 2032.

- Emission Reduction Potential: While the US has sufficient mineral reserves with its trade partners, current production levels could only meet about half of the EV demand, potentially compromising the full lifecycle emission reduction targets.

New Model Assesses Critical Mineral Supply Chain

Researchers have developed a new model to look at how robust the supply chain is for an ever-expanding EV market by looking at EV sales volume scenarios that conform to the US light-duty vehicle electrification targets that have been set, assessing whether existing US mineral supply chains can accommodate the required manufacturing increase to meet the sales targets and the potential emission disequilibrium between mineral supply and demand.

The model looks at EVs as a substitute for ICEVs rather than a complementary vehicle. The model recognises that the US cannot be self-sufficient in a number of key minerals—namely cobalt, graphite, and manganese—and that there are geopolitical considerations that need to be accounted for as some countries have a disproportional influence over the EV supply chain that can limit the supply of critical minerals. So, with this in mind, the model looks at mineral supplies that are either mined domestically in the US or in countries where the US has a free trade agreement—so they will have access to these materials.

The researchers created the model to better inform public policies that focus on electrification and transport-related emissions by providing realistic insights into mineral supply chain constraints. Because the model looks at geographic patterns associated with mineral supply constraints, it is hoped to be used as a guide for addressing economic and US national security concerns related to potential mineral shortfalls.

Results of the Model

The model discovered that by 2032, at least 37.82% of new vehicle sales must be EVs to meet the US tailpipe emission proposal. The number is lower than other projected estimates in the past because it considers the projected emission profiles of ICEVs and hybrid electric vehicles (HEVs) and how their fuel economy is continuously improving.

The model also showed that from mineral reserves alone, the requisite number of EVs required to meet compliance is plausible across five of the six battery chemistries analysed, meaning that the total quantities of economically extractable minerals contained in the US and partner countries are theoretically sufficient to meet the required EV manufacturing demand.

The researchers found that the mineral reserves available to the US domestically and with their partners could support the deployment of between 81.66 million and 989.27 million EVs based on different lithium nickel manganese cobalt oxides (NMC), lithium nickel cobalt aluminium oxides (NCA) and lithium iron phosphate (LFP) batteries—which could equate to 76.2 million tonnes of CO2 savings per year. This is higher than the number of EVs that would be required to meet the incoming legislation.

The results imply that EV manufacturers could satisfy EV demand using different battery chemistries. However, access to geological mineral reserves depends, in practice, on mineral production capacity. The cumulative economically viable supply reflects the production rates based on the existing extraction capacity and is a good gauge as to whether mining supply efforts could meet the incoming demand.

With this in mind, even though the reserves could theoretically produce a lot more, the current mineral production rates of the US and its allies suggest that a maximum of 5.09 million EV batteries could be feasibly produced between 2027 and 2032. This value is much lower than the required demands of the new policy, where the lowest sales scenario investigated still required the sale of 10.2 million EVs. Based on the demands of the new policy, current supply methods will only be able to satisfy 50.13% of overall EV demand.

The results showed that graphite is one of the main limiting materials because the battery chemistry that has the potential to produce over 5 million vehicles is NMC 811 EV batteries—and these require a lot of graphite, but NCA and LFP battery chemistries require more graphite than NMC. For reference, if the EVs produced were solely based on LFP chemistries, the graphite shortfall would cause 70.78% of unmet EV demand, while NCA would correspond to at least 53.96% of unmet demand.

Graphite and Cobalt the Limiting Factors

Graphite is the main mineral constraint for EV batteries, but cobalt is also an obstacle to large-scale EV deployment if a combination of NMC and NCA batteries are used to meet demand. The model showed that an increase in other key minerals— aluminium, copper, lithium, manganese, and nickel—will not improve the production output if the level of graphite and cobalt supply doesn’t increase, meaning that graphite and cobalt production are going to have to be the two driving factors if EV demand is to be met (otherwise they will be the limiting factors).

Based on the new announcements for new natural graphite mines and synthetic graphite plants in the US, alongside graphite production from their partner countries, the US could have access to 173,000 tonnes of graphite per year by 2026. This could further increase to 225,000 tonnes per year by 2032.

However, this is still not enough to meet the required annual EV sales by 2032. Even assuming the most optimal battery chemistry (NMC 811), the US would require 331,000 tonnes of battery-grade graphite to be available. This is a 590% increase in graphite production compared to today. If a mix of battery chemistries are utilised (due to cost constraints), the increase in graphite production required could be as high as 880%.

For cobalt, around 37,000 tonnes would be required per year to meet demand. This is 69% more than is produced today, but it is not as drastic of an increase compared to graphite. In fact, this number could drop to only a 42% increase in cobalt production compared to today if a range of battery chemistries are utilised—the opposite of how it would affect the graphite supply chain.

Mineral constraints outside of graphite and cobalt have become less important, and the present-day mineral production of aluminium, copper, lithium, manganese, and nickel is sufficient to meet the electrification goals of the new US policy in all sales scenarios.

The study also showed that based on the viable mineral reserves available, manufacturing enough EVs in line with the policy could reduce CO2 emissions by up to 457.3 million tonnes. However, with the material constraints potentially causing a shortage of deployed EVs against targets, this could also lead to at least 59.54 million tonnes of CO2 in lost lifecycle emissions benefits.

The study has put together evidence that the EV targets being set by the US government could deliver significant emission reduction, but mineral production constraints could hamper the extent of emission reduction. There are more than enough mineral reserves in the US and associated partners, but not the mineral production capacity to meet the demands of the new US policy by 2032. This could change in the future but will require some significant investments and increased mineral production capacity—in particular, for graphite.

Reference: