The Rise of Automotive Semiconductors: A 290B Euros Market by 2030

09-05-2023 | By Paul Whytock

For the past thirty years, chipmakers that have consistently supported automotive companies with supplies of semiconductor devices were considered somewhat unfairly as the pedestrians of the global chip-making community.

During that time, it was fair to say that other application markets like communications and computing were where big money was being made, and typically those areas would often account for up to 70% of global semiconductor sales.

But it’s also fair to say that those markets were highly volatile, and what could one year have corporate CFOs (chief financial officers) of semiconductor companies jumping for joy could the following year send the same bean counters down into a deep valley of despair as massive over-supply of devices such as memory chips caused world prices to drop and profits to plummet.

During such market contractions, those supposed pedestrian chipmakers reaped the benefit from their loyal supply of devices to car makers. Admittedly, there were certain times in the past three decades the market demands from the automotive sector could fluctuate, but nothing compared to the extreme price/production volatility of other markets.

The Big Reward

So the car chipmakers enjoyed a constant, if not spectacular, return on investment via their commitment to the car makers. However, that patience is about to be rewarded in a big way.

According to Polaris Market Research, the global demand for automotive semiconductor devices is set to grow significantly during the rest of this decade at a CAGR of 8.3%, with some estimates even reaching as high as 15.5%1.

Largest Growth Rate

According to the 2022 Semiconductor End-Use Survey from the World Semiconductor Trade Statistics (WSTS) organisation, the automotive applications area experienced its largest growth during the past year, and the automotive sector’s share of global semiconductor sales could reach 14.1%. The Asia-Pacific area is expected to be the highest-growth market for automotive chips.

Current analysis by industry pundits on what the global car electronics business could be worth by 2030 varies enormously, but taking an average from a sample of statistics indicates a value of €290billion. So who are the pedestrian chipmakers now?

Current Market Players

Prime among the companies that have remained a constant supporter and supplier to the global automotive market during all this time is German device maker Infineon.

Not surprising then is the company’s decision to go ahead with a new 300mm Smart Power Fab in Dresden that will manufacture semiconductor solutions for automotive applications. The German Federal Ministry for Economic Affairs and Climate Action approved an early project launch.

The project was subject to the European Commission’s state aid decision and the national grant procedure, and the project is partly funded under the auspices of the European Chips Act.

The company believes its investment in this new manufacturing facility is a valuable contribution to achieving the European Commission’s declared objective of attaining a 20% share of global semiconductor production by the EU by 2030.

Dealing With EV Range Anxiety

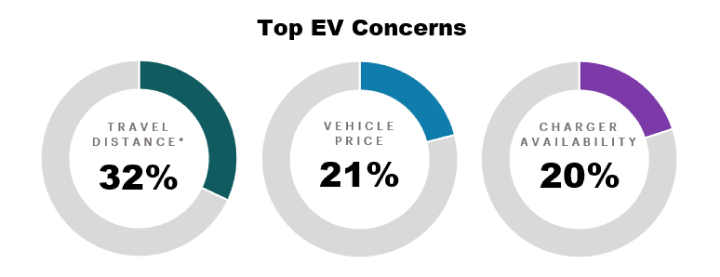

In addition, Infineon has just announced a collaboration with printed circuit board (PCB) specialists Schweizer Electronic to increase the efficiency of chips based on silicon carbide (SiC). Both partners are developing a solution to embed Infineon’s 1200 V CoolSiC devices directly onto PCBs. This, the companies claim, will increase the range of electric vehicles.

The two companies have already demonstrated the potential of this new approach by embedding a 48V MOSFET on a PCB, resulting in a 35% increase in performance. The switching characteristics of the CoolSiC devices are enhanced by the low-inductance interconnection that can be achieved with the PCB.

Other Major Players and Strategies

But Infineon is not alone in recognising the substantial global increase in demand for automotive semiconductors. The market is dominated by big players, such as NXP Semiconductor, Renesas Electronics Corporation, Texas Instruments, STMicroelectronics, and others.

Players in the automotive semiconductor arena are adopting strategies such as partnerships, mergers, collaborations and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Amongst examples of this are Onsemi’s opening of a silicon carbide facility in the US, a facility the company claims will increase production five-fold, and Renesas Electronics Corporation partnering with Cyberon Corporation to provide voice user interface solutions for customers using the company’s RA MCU products.

Here in Europe, NXP Semiconductors established a collaborative agreement with Foxconn that will focus on using NXP’s automotive devices in the development of architectural systems on electric vehicles.

Infineon has announced a strategic cooperation with Taiwanese manufacturer UMC to increase the capacity of microcontroller products. These will be manufactured at UMC’s Singapore fab on its 40nm process.

The Driving Forces

Areas of vehicle design that will continue to drive the automotive electronic devices market include conventional ICE vehicles, electric vehicles, hybrid vehicles and plug-in hybrid vehicles. Developments towards autonomous vehicles will also consume electronics technology but are still very much in their early development, and it will be many years before level 5 fully autonomous vehicles are produced in any significant numbers.

The actual devices that take the largest share of the overall global automotive electronics business are power devices. The global automotive power electronics market size is projected to grow from USD 3.8 billion in 2020 to USD 4.7 billion by 2025, at a CAGR of 4.7%2."

A key technological development driving the increase of power semiconductor devices in car design is the use of components based on gallium nitride (GaN) and silicon carbide (SiC).

These provide designers with critical advantages, and amongst these are high operating efficiencies via reduced on-resistance, which consume less power and the devices can be made smaller yet still have the required levels of heat dissipation. The last factor is important when devices have to operate in high-temperature locations, as is sometimes the case with automotive applications. Gan and SiC components can often operate without the need for complex and expensive thermal management systems.

References:

-

Polaris Market Research. (n.d.). Global Silicon on Insulator (SOI) Market Size Estimated to Attain USD 5.83 Billion Value by 2032, at 15.5% CAGR Growth: Polaris Market Research. PR Newswire. Retrieved from https://www.prnewswire.com/news-releases/global-silicon-on-insulator-soi-market-size-estimated-to-attain-usd-5-83-billion-value-by-2032--at-15-5-cagr-growth-polaris-market-research-301818277.html ↩

-

MarketsandMarkets. (n.d.). Automotive Power Electronics Market Size, Share by 2025. Retrieved from https://www.marketsandmarkets.com/Market-Reports/automotive-power-electronics-market-226516353.html ↩