Semiconductor Shortage – See it for Yourself

18-05-2021 | By Robin Mitchell

In this article, we will look at what caused the worlds current semiconductor shortage as well as real-world evidence of the shortage.

What caused the semiconductor shortage?

The world is currently facing a shortage of semiconductors, and it is not just the automotive industry that is affected; even standard commercial semiconductors are in short supply! But to understand why we are in this position, we have to go back to December 2019…

The end of 2019 saw a prosperous economic year, unemployment was down, and it seemed that life was only going to get better. But, of course, this was when COVID-19 made a grand entry into the population. Within a few months of the first detection, governments worldwide introduced strict lockdown rules, stopped international travel, and of course, industries ground to a halt.

With virtually no one using the roads and staying at home, the automotive industry saw a plummet in sales and therefore decided to halt the production of new vehicles. With the combination of zero demand from the automotive industry and the increase in demand for consumer electronics, semiconductor manufacturers also decided to stop producing automotive parts and switch over to consumer electronics.

Now, this would not have been a problem if semiconductors could be made in a day or two (like PCBs), but unfortunately, semiconductors take anywhere between 6 months to a year to go from wafer to finished product. When the automotive industry reopened, they all wanted components that had not been in production for a year, and as such, stocks of those components quickly vanished.

So automotive components are now seeing delays of up to a year, but this delay has now spread to consumer electronics. Simply put, many semiconductor manufacturers have recognised the dire need for automotive components and are therefore prioritising their fabrication. But, this means that other electronics are now suffering delays and the results of these delays can be seen from distributors!

Real-World Examples of Delays

To understand how the delay affects components, we will look at several components commonly used in the consumer electronics industry. We will look at the PIC18 range, STM32 range, memory, controllers, and FPGAs.

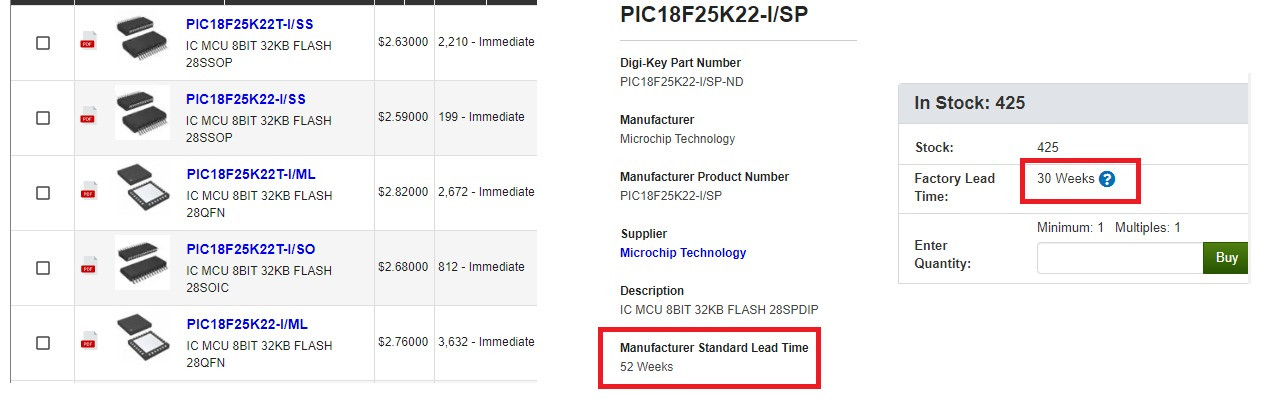

PIC18F devices

The PIC18F devices are versatile 8-bit microcontrollers with a powerful range of peripherals. Distributors such as Farnell, DigiKey, and Mouser all have these parts in stock, and their fading use in consumer electronics will probably see stock levels last for some time. However, observing most of these parts shows a 52-week delay on the items (i.e. a year), which is indicative of the fabrication plant facing delays as a result of COVID.

STM32 devices

The STM32 range of devices is the electronics workhorse of ARM microcontrollers. Their unified architecture, powerful processor, and extensive range of variations make them popular in consumer, industrial, and maker industries. However, while the STM32 is immensely popular, multiple sites selling this device show a minimum lead time of 52 weeks, and some sites are completely out of stock. This shows that there is currently an STM32 shortage.

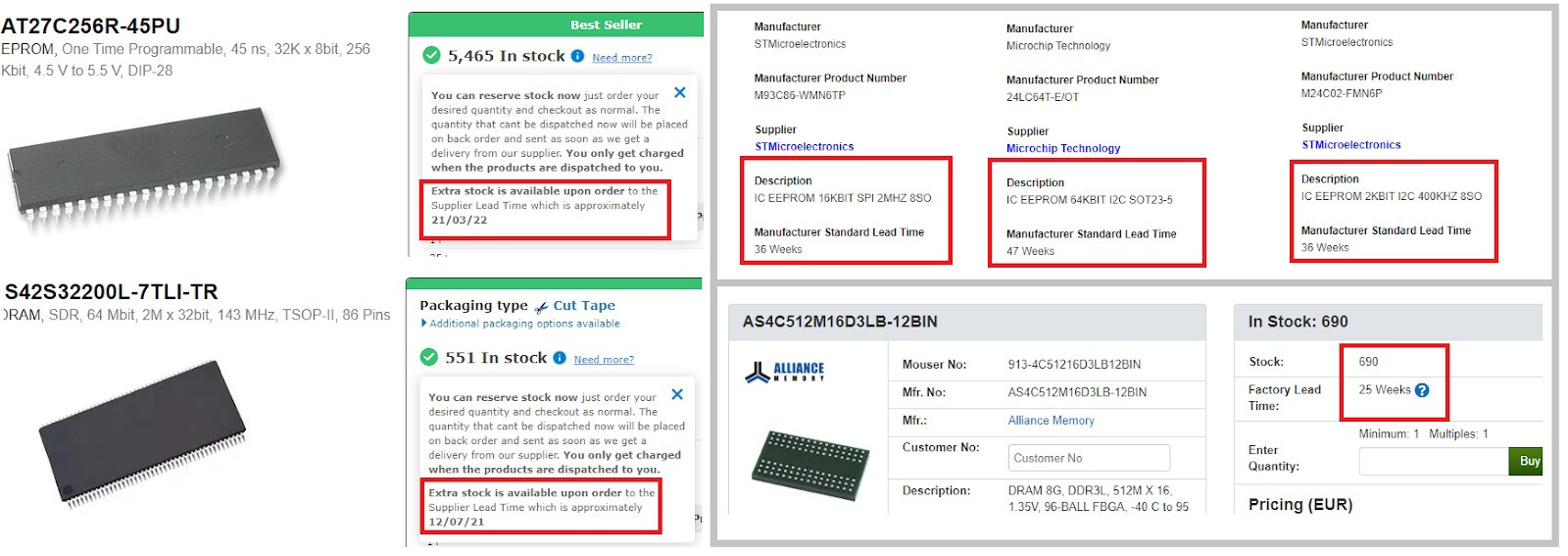

Memory

Delays and availability of memory depend on the type of memory as well as who manufactures the part. Specifically, DRAM appears to be unaffected with delays being up to 14 weeks. Still, serial EEPROM devices show long lead times in excess of 30 weeks, and the companies that appear to be most affected are STMicroelectronics and Microchip.

FPGAs

FPGAs are another component that is either hit and miss with availability. Some devices (such as those produced by Lattice Semiconductor), can provide thousands of FPGAs within 10 to 15 weeks while others (such as Xilinx), have extremely long waiting times. Both companies are fabless but may use different chip suppliers, explaining why some chip manufacturers are affected and others are not. FPGAs shortages are being experienced worldwide.

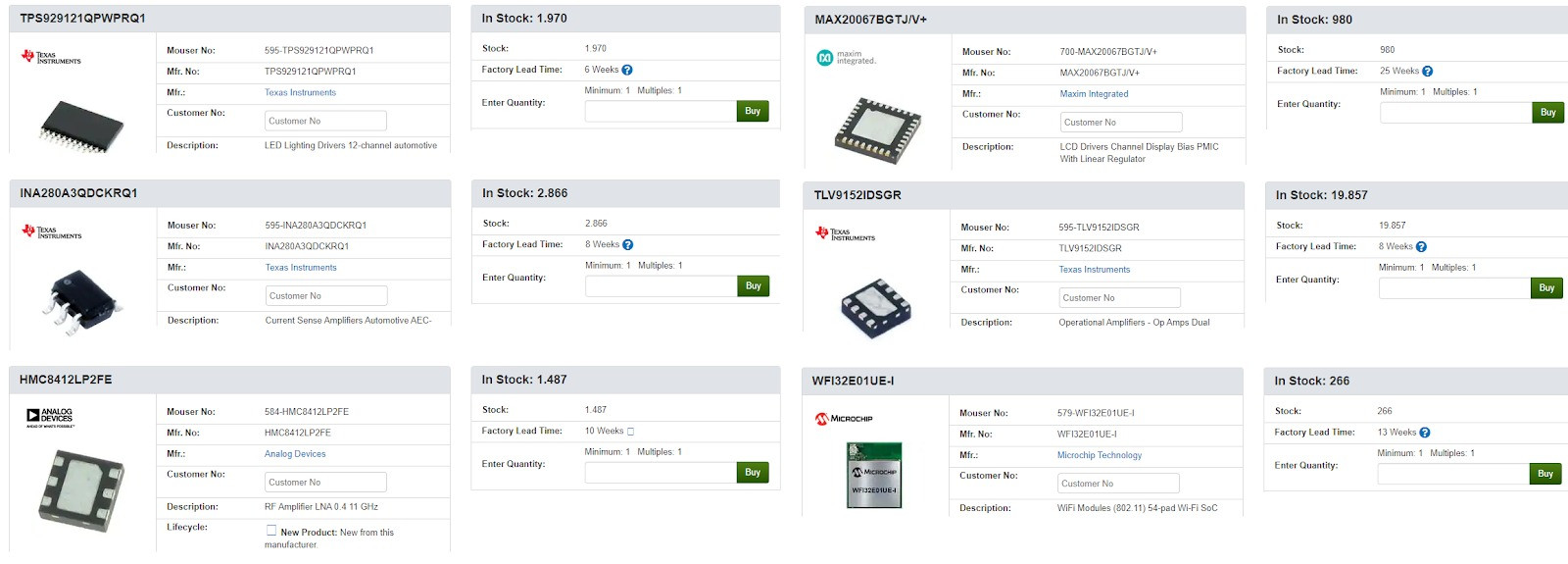

Controllers and drivers

Controllers and drivers are mostly unaffected with the more complex devices having longer waiting times regardless of the manufacturer. For example, Microchip has long waiting times on its microcontrollers, but their Wi-Fi SoC and various other components have relatively short lead times (several weeks instead of a year).

Conclusion

After exploring different semiconductors it becomes obvious which ones are affected, and those that are not. To start, companies that are involved with automotive components (such as STMicroelectronics), face delays as they attempt to gear up production for that industry. In addition, fabless companies are hit and miss depending on their supplier (for example, TSMC is currently prioritising automotive components). In contrast, those that produce their own components generally have a lower waiting time (such a Texas Instruments).

However, the biggest factor by far seems to be device complexity; the more complex a device is the longer the waiting time. This would make sense when considering that complex devices require more layers on the wafer which takes more time to fabricate, and the larger die size results in fewer devices being made per wafer. Thus, simple transistors and amplifiers are essentially exempt from the delays, but complex processors and controllers are most likely to be affected to some degree.

Read More