ARM to Launch Its Own Chip – Challenging the Fabless Model

17-03-2025 | By Robin Mitchell

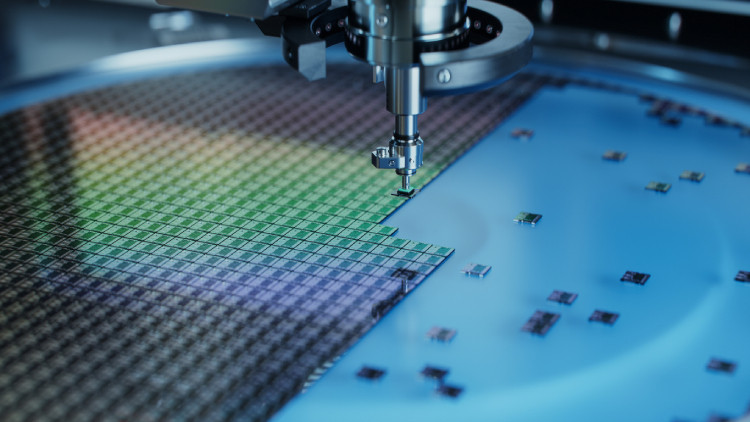

While the semiconductor industry has long relied on integrated device manufacturing to propel innovation, soaring production costs and increasingly complex technologies have prompted a search for new business models. Recently, Arm—a key player in chip design—has signaled a pivotal shift by moving to manufacture its own CPUs for the data center market.

Key Things to Know:

- Arm enters chip manufacturing: The UK-based semiconductor giant is moving beyond licensing designs to producing its own CPUs, a shift that could disrupt the $700bn semiconductor industry.

- Strategic shift towards AI and data centres: Arm's new chip is expected to power servers in large data centres, with Meta among its first major customers. The chip is designed for AI workloads and high-performance computing.

- Challenges in supply chain and competition: Outsourcing production to TSMC raises supply chain concerns, while Arm's move puts it in direct competition with long-time partners such as Qualcomm and Nvidia.

- The impact of the Stargate initiative: Arm is a key player in SoftBank’s $500bn Stargate project, which aims to build an advanced AI network alongside companies like Nvidia, Microsoft, and Oracle.

What challenges do semiconductor companies currently face, how is Arm breaking new ground with its own chip design, and what broader implications could this move have for the industry’s transition toward fabless manufacturing?

Navigating the Complex Landscape of Semiconductor Manufacturing

The semiconductor industry is one of the most complex and challenging sectors to navigate, with a rich history spanning several decades. From its humble beginnings to the sophisticated systems of today, the industry has undergone a significant transformation over the years, and the transition from integrated device manufacturing to fabless models is a prime example of this change. Initially, semiconductor companies designed and manufactured their own products, but with advancements in technology and increased costs, they shifted their focus to designing and licensing their technologies to others for production.

The High Costs of Semiconductor Foundries: A Barrier to Market Entry

One of the significant challenges faced by semiconductor companies is the high costs associated with setting up and maintaining fabrication plants, commonly known as foundries. These costs are staggering, with a single facility costing billions of dollars to establish and maintain. This financial burden not only affects larger companies but also hinders smaller companies and startups from entering the industry. The high capital expenditure required to build and maintain foundries makes it difficult for new entrants to compete with established players, thus creating a barrier to entry.

The Semiconductor Skills Gap: Why Talent Acquisition is a Challenge

In addition to the financial costs, semiconductor manufacturing also demands a high level of technical expertise and experience. Designing and producing semiconductors requires specialised knowledge in both semiconductor design and production, and the need for skilled professionals in the field introduces a significant challenge, especially for new companies looking to enter the market. The competition for top talent is fierce, and retaining skilled employees can be difficult due to the limited number of job openings available. This scarcity of skilled professionals makes it challenging for companies to navigate the complexities of semiconductor manufacturing and maintain a competitive edge in the market.

Navigating the Learning Curve: The Challenges of Semiconductor Startups

Another significant challenge faced by new companies is the steep learning curve and resource-intensive nature of semiconductor manufacturing. The transition from a design-oriented company to a fully fledged semiconductor manufacturer requires a substantial investment of time, money, and resources. The process involves not only designing the chip but also navigating the complexities of the fabrication process, which can be prone to delays and potential pitfalls. The intricate details involved in translating designs into actual chips make the process extremely challenging, and any mistakes or setbacks can be costly and time-consuming to rectify.

Furthermore, the competitive landscape of the semiconductor industry is dominated by established players, making it challenging for new companies to break into the market. The barriers to entry are high, and the competition for market share is fierce. The combination of high costs, technical expertise requirements, and the need for substantial resources makes it difficult for new companies to gain traction and establish themselves as major players in the industry.

The Rise of Fabless Semiconductor Companies: Opportunities and Challenges

In recent years, there has been a shift towards fabless companies, which design and license their technologies to others for manufacturing. This business model has been adopted by many semiconductor companies due to the high costs and complexities associated with manufacturing, yielding fantastic results. The fabless model allows companies to focus on designing and licensing their technologies, thereby reducing their financial burden and increasing their profitability. However, this model also presents challenges, particularly in the design-to-chip transition, where companies need to ensure that their designs are compatible with the manufacturing processes of their partners. Such challenges faced during this transition can lead to potential pitfalls and delays, which can impact the overall success of the company.

Arm to Enter Chip Manufacturing Market with New Design

In a move that could see Arm compete with its major customers, the UK-based semiconductor designer is reportedly planning to launch its own chip this year. Arm's strategic entry into chip manufacturing could reshape the semiconductor industry, especially as traditional fabless models shift towards in-house production. This move aligns with broader industry trends where companies seek greater control over chip design, integration, and performance optimisation, reducing reliance on external manufacturers. Analysts suggest that this transition could significantly impact existing licensing agreements and competitive relationships.

According to sources close to the company, Arm is aiming to unveil the chip as soon as this summer, with the goal of providing a central processing unit for use in servers in large data centres.

Arm’s Upcoming Chip: What We Know So Far

The move marks a significant shift in Arm's business model, which has traditionally focused on licensing its chip blueprints to other manufacturers. This pivot comes at a time when semiconductor companies are grappling with escalating fabrication costs and increasing demand for custom chips optimised for AI and high-performance computing. Industry insiders suggest that Arm’s shift mirrors similar trends observed at companies like Apple, which transitioned to in-house chip production with its M-series processors, securing greater performance efficiencies and proprietary advantages. However, the company's recent partnerships with Nvidia and Amazon in the data centre market have driven its growth, and the introduction of its own chip could help Arm become a major player in the $700bn semiconductor market.

Customisation and AI Optimisation: How Arm Plans to Compete

While the exact specifications of the new chip are yet to be confirmed, it is expected to be customisable for clients, including Meta, who has recently announced that it will be using Arm chips in its servers. The collaboration with Meta highlights a growing demand for specialised silicon in AI-driven workloads. Meta’s recent focus on AI hardware development underscores the need for server chips optimised for large-scale machine learning operations, an area where Arm’s power-efficient architecture could provide distinct advantages. Industry observers speculate that customisable Arm-based chips could lead to a new wave of silicon tailored specifically for cloud and AI applications. The chip will be manufactured by a third-party company, such as Taiwan Semiconductor Manufacturing Co (TSMC), and will be designed to work with AI assistants, such as those developed by OpenAI and Meta.

The move by Arm to enter the chip manufacturing market is not entirely unexpected, as the company has been looking to expand its capabilities in recent years. Arm’s entry into manufacturing also introduces potential challenges, particularly in securing supply chain resilience. Outsourcing production to Taiwan Semiconductor Manufacturing Co (TSMC) raises concerns amid global semiconductor shortages and geopolitical uncertainties. With increasing calls for semiconductor self-sufficiency in the US and Europe, industry experts question whether Arm will eventually pursue domestic fabrication partnerships to mitigate supply chain risks.

The Stargate Initiative: Arm’s Role in AI Infrastructure

In January 2025, SoftBank founder Masayoshi Son announced the Stargate initiative to build a vast AI network in which Arm will play a key role. The Stargate initiative exemplifies a broader industry push towards vertical integration in AI infrastructure. By embedding Arm-designed chips within a $500bn AI network, SoftBank is positioning itself at the forefront of AI hardware development. This move could strengthen Arm’s influence in next-generation computing architectures, particularly in the race for power-efficient AI accelerators capable of handling massive workloads. The initiative, which is expected to be worth $500bn, will see Arm partner with companies such as Nvidia, Microsoft, and Oracle to develop AI-powered solutions.

The Emergence of New Fables Strategies in the Semiconductor Industry

The recent decision by Arm to launch its own branded CPU for servers in large datacenters marks a new shift in the semiconductor industry, with fabless companies potentially stepping on the toes of their customers. For decades, Arm has been a leading provider of chip blueprints to manufacturers, with its designs being used in a wide range of applications, from smartphones to datacenters. However, the move by Arm to manufacture its own CPUs for datacenters introduces a new dynamic to the industry, with potential implications for both manufacturers and consumers alike.

How Arm’s Entry into Chip Manufacturing Will Reshape Industry Competition

The first major impact of Arm's move into manufacturing is that it will likely change the competitive landscape of the semiconductor industry. As a fabless company, Arm has historically relied on third-party manufacturers to produce its designs. However, by manufacturing its own CPUs, Arm will be able to control the entire production process, from design to delivery. This could give Arm a significant advantage over its competitors, as it will be able to optimise its products for specific applications and ensure that they meet the highest standards of quality.

The move by Arm into manufacturing also has implications for the broader semiconductor industry. As a major player in the industry, Arm's decision to manufacture its own CPUs could encourage other fabless companies to follow suit. This could lead to a shift in the industry, with more companies focusing on design and development rather than manufacturing. This, in turn, could lead to a more specialised industry, with companies focusing on specific areas of expertise, such as design, testing, and validation.

What This Means for Engineers: Adapting to a Changing Semiconductor Landscape

The emergence of new fabless strategies in the semiconductor industry also has implications for engineers and technical teams. The shift towards more specialised companies could lead to a greater demand for skilled professionals in areas such as design, testing and validation. Engineers and technical teams will need to be adaptable and able to work with a wide range of technologies and systems, as the industry continues to evolve and change.

The move by Arm also has implications for the supply chain, with potential risks around supply chain management and partner relationships. As Arm will be manufacturing its own CPUs, it will need to establish strong relationships with suppliers and manufacturers to ensure a stable supply of components. However, the use of third-party manufacturers also introduces risks around quality and reliability, which will need to be carefully managed by Arm.

Overall, the emergence of new fableless strategies in the semiconductor industry is a significant development that has far-reaching implications for both manufacturers and engineers alike. As the industry continues to evolve, it will be important for engineers and technical teams to be adaptable and able.