China Bluetooth Alternative: Star Flash Set for 2025 Rollout

15-04-2025 | By Robin Mitchell

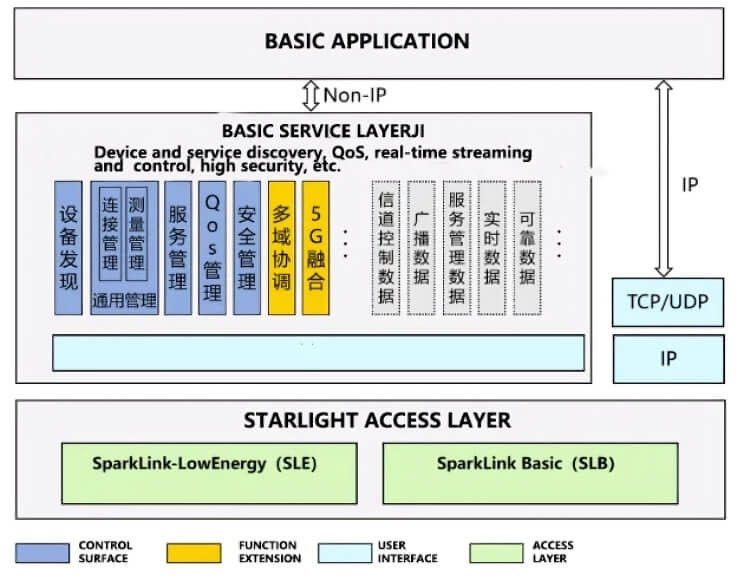

Architecture of China’s Star Flash Protocol: A three-tier system featuring a Basic Application layer, a robust Basic Service Layer with high-security and QoS support, and dual-mode Starlight Access Layer (SLE/SLB) for low-energy and high-bandwidth communication.

While China’s tech industry has historically relied on foreign expertise and imported components, the mounting drive for self-sufficiency is transforming the nation’s innovation landscape. Recently, Chinese authorities have doubled down on a strategy to cultivate domestic technology capabilities—exemplified by initiatives such as the emerging Star Flash wireless standard—which aim to reduce reliance on global suppliers and overcome external restrictions.

Key Thing to Know:

- China unveils Star Flash: A new wireless communication protocol aimed at reducing reliance on Bluetooth and foreign wireless technologies, featuring a scalable three-tier architecture.

- Universal remote control standard approved: Devices must now support voice commands and be compatible with infrared, Bluetooth, or Star Flash, marking a shift towards seamless smart home integration.

- Huawei plays a key role: Despite global restrictions, Huawei remains instrumental in developing Star Flash, enabling low power consumption, high bandwidth, and multi-device connectivity.

- Nationwide rollout by 2025: Backed by government initiatives, Star Flash is expected to reach millions of devices, driving adoption across consumer electronics, healthcare, and IoT platforms.

What challenges does China face in its pursuit of technological independence, what groundbreaking developments have emerged from this push for self-reliance, and what could these shifts mean for the future of global tech leadership?

Navigating the Complexities of China's Technological Independence

Historically, China has been heavily dependent on Western technology, with the majority of its electronic components and high-tech equipment sourced from countries such as the US, UK, and Japan. In the early stages of China's tech growth, this dependence was not a major concern, as foreign companies were eager to invest in the Chinese market and capitalise on its vast consumer base. Moreover, China's government actively encouraged foreign partnerships and investments, offering favourable business conditions and tax incentives. This influx of foreign capital and expertise helped China rapidly expand its tech industry, with many Chinese companies becoming leaders in their respective fields.

China’s Strategic Shift Towards Technological Self-Reliance

However, in recent years, China's government has shifted its focus towards technological independence, recognising the risks associated with relying on foreign technology. The COVID-19 pandemic, which originated in China, further exacerbated these concerns as the country struggled to access essential medical supplies and equipment. The subsequent trade wars between China and the US have only intensified this desire for self-reliance, with China facing restrictions on accessing cutting-edge technologies such as AI, semiconductors, and advanced telecommunications equipment.

China's isolation from the global tech market introduces significant challenges, primarily in accessing the latest technologies and innovations. Without access to Western markets, Chinese companies are forced to develop their own technologies from scratch, often resulting in a slower pace of innovation. Furthermore, the lack of global market access makes it difficult for Chinese companies to stay competitive, as they are unable to adapt to changing market trends and consumer demands.

Challenges of Innovation and Intellectual Property in a Closed Tech Ecosystem

The pressure to innovate independently has also led to a surge in research and development activities within China's tech industry. While this has resulted in significant advancements in certain areas, such as AI and robotics, it has also led to a widening gap in technological capabilities between China and the West, particularly in areas such as semiconductors and advanced telecommunications equipment.

Intellectual property concerns and tech sanctions have also been major challenges for China, with ongoing issues related to intellectual property rights and enforcement. The lack of effective IP protection mechanisms has led to widespread counterfeiting and piracy, which not only hinders innovation but also undermines consumer trust in Chinese products. The strain on international collaborations and partnerships due to tech sanctions has further exacerbated this issue, making it increasingly difficult for Chinese companies to access foreign technologies and expertise.

Despite the challenges, China remains committed to its pursuit of technological independence, recognising the importance of self-sufficiency in the long run. However, this push for self-reliance also raises concerns about the potential for technology silos, where Chinese companies are unable to access foreign technologies and innovations. The lack of global market access and the restrictions on accessing cutting-edge technology may also hinder China's ability to stay competitive in the long run, potentially leading to a decline in its global tech leadership.

China Launches Homegrown Bluetooth Alternative – Star Flash: A New Era in Consumer Electronics

China has recently initiated the development and deployment of a homegrown Bluetooth alternative known as Star Flash. The move, part of a broader strategy by the Chinese government to reduce its reliance on foreign wireless communication systems, is expected to transform the consumer electronics landscape in the country.

Unlike conventional wireless standards, Star Flash incorporates a three-tier architecture that strengthens both performance and scalability. At the core is the Basic Application Layer, which supports varied use cases across consumer electronics, including automotive infotainment and smart home integration. This is underpinned by a Basic Service Layer offering stability and systemic reliability through modular functions. These tiers are then connected via the Access Layer, which enables Star Flash to flexibly support both high-performance (SLB) and low-power (SLE) transmission modes across unlicensed 5GHz and 2.4GHz bands respectively.

According to sources, the Electronics Video Industry Association of China has approved a standard for universal remotes designed to simplify consumer device management and improve user experience. The standard mandates that all universal remotes must support voice commands and utilise either infrared, Bluetooth, or the newly developed Star Flash technology. The goal of the standard is to enable seamless interaction and control between devices such as televisions and set-top box systems, eliminating the need for multiple remotes and enhancing overall user convenience.

Universal Remote Control Standards Drive Star Flash Adoption

To facilitate this seamless user experience, Star Flash’s SLB (Basic Access) interface focuses on delivering high bandwidth and ultra-low latency, which is essential for real-time control applications such as voice-activated commands and high-fidelity AV streaming. In contrast, the SLE (Low Power Access) interface caters to battery-operated devices where power efficiency and reliable interconnectivity are critical, such as remote controls and wearables. This dual-mode access architecture enhances interoperability across a growing ecosystem of devices.

Manufacturers have already begun adopting the new standard, with Konka recently delivering its first Smart TV that is compatible with the universal remote. The introduction of the universal remote is a significant step towards the widespread adoption of Star Flash technology in consumer electronics.

Huawei’s Role in Star Flash Development and Its Technical Advantages

Star Flash, developed in collaboration with the SparkLink Alliance, comprises numerous Chinese tech companies and manufacturing giants, including Huawei. Despite being banned in the US due to security concerns, Huawei remains a key player in the development and deployment of Star Flash technology. The new technology has several advantages over existing wireless communication systems, including its ability to support multiple simultaneous device connections, low power consumption, and lossless stereo audio streaming.

These technical capabilities are enabled by innovations such as ultra-short frame structures and multi-point synchronisation, which improve communication efficiency without compromising reliability. Star Flash also supports asynchronous HARQ (Hybrid Automatic Repeat Request), a technology borrowed from high-tier telecom systems, that improves data throughput under challenging network conditions. Such features highlight Star Flash’s ambition not just to compete with Bluetooth, but to redefine short-range wireless communication.

Government-Backed Rollout: Scaling Star Flash Nationwide by 2025

The Chinese government is actively promoting the adoption of universal remote controls equipped with Star Flash technology and plans to implement the standard nationally by 2025. This initiative is expected to accelerate the widespread adoption of StarFlash in millions of domestic devices, thereby providing manufacturers with the scale and market demand needed to further invest in the technology.

Industry observers suggest that Star Flash’s potential could extend beyond universal remote control systems. With built-in support for reliable multicast and secure pairing mechanisms, Star Flash is well-positioned to address the demands of next-generation IoT ecosystems. These include smart manufacturing, intelligent healthcare devices, and connected vehicle platforms, where consistent communication and minimal latency are non-negotiable.

Forging Ahead: How China's Self-Sufficient Tech Vision Will Reshape Tomorrow

As China continues its pursuit of technological independence in the face of rising tensions with the West, the nation is rapidly transforming its tech landscape. The push for self-reliant innovation is driving a new era of technological development, with far-reaching implications for both China and the global tech industry.

The introduction of Star Flash technology marks a significant step towards China's tech independence, starting to free it from Western control. However, the adoption of standards like Star Flash also raises concerns about interoperability and compatibility with devices from other manufacturers. As China's tech industry continues to grow and become more isolated from the global market, it is likely that the country will face challenges in accessing cutting-edge technologies and innovations from abroad. This could lead to a widening gap in tech capabilities between China and the rest of the world, potentially hindering China's ability to stay competitive in emerging markets.

The push for self-reliability in China's tech sector also presents opportunities for engineers to explore new research avenues and develop innovative solutions. As the country continues to invest heavily in R&D, there will be a growing demand for specialised skills that bridge different systems and technologies. Engineers who can adapt to new protocols and communication methods will be in high demand, driving a shift towards a more diverse and specialised workforce.

However, the rapid experimentation and commercialisation of new technologies in China also raise concerns about the potential for fragmented ecosystems and reduced interoperability. If China successfully proves the advantages of its self-sufficient tech approach, it could lead to a shift in global tech leadership towards regions that prioritise autonomous innovation. This could pose a significant challenge for the West, which may struggle to keep pace with emerging markets that are willing to take risks and invest in cutting-edge technologies.

Overall, the Chinese push for self-reliable innovation is transforming the tech landscape, with far-reaching implications both domestically and globally. While the adoption of proprietary standards and homegrown technologies like Star Flash presents challenges for interoperability and compatibility, it also offers opportunities for engineers to explore innovative solutions and develop specialised skills. As China continues to invest in R&D and drive technological advancements, it is likely that the country will emerge as a major player in the global tech industry, potentially reshaping the future of wireless communication and beyond.